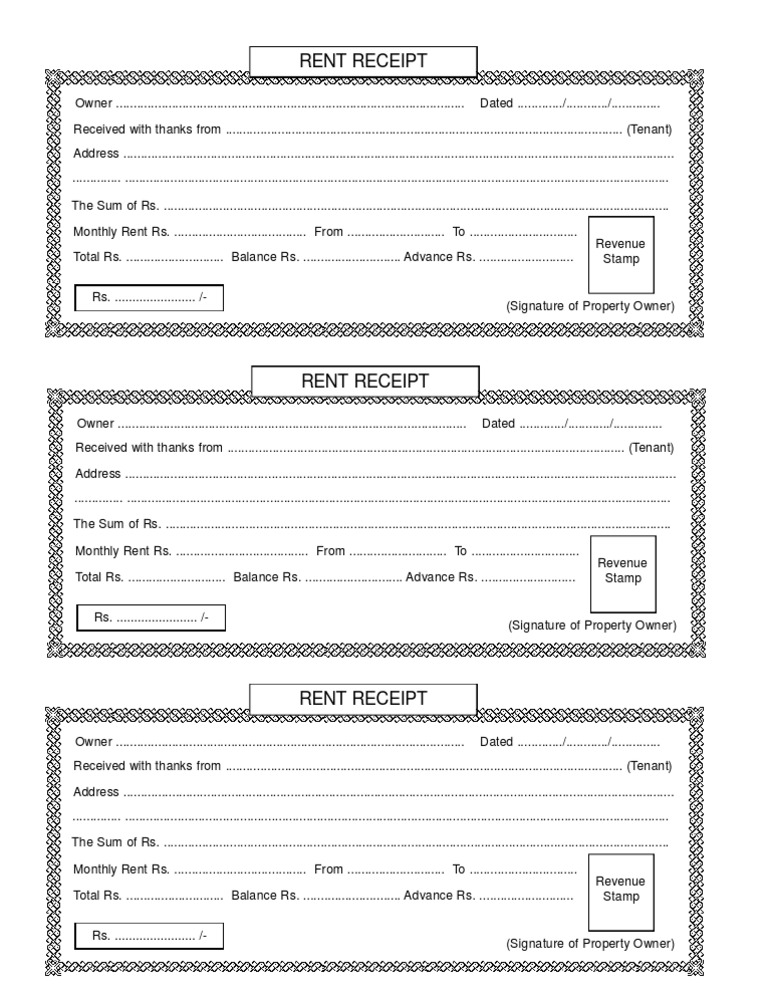

House rent receipt format india income tax pdf The federal government knows college is expensive. Federal tax law offers multiple options for using any tuition you pay for yourself or your family to cut your taxes. Some of the student fees and equipment may be covered too, but none of the tax-saving options include room and board. If you are looking for House Rent Receipt Template India you have come to the right place. We have many more template about House Rent Receipt Template India including template, printable, photos, wallpapers, and more. In these page, we also have variety of images available. Such as pdf, jpg, animated gifs, pic art, logo, black and white, transparent, etc. Rent Receipt Date Received from The Sum of Dollars For the Period to For Rent at Received by Address Landlord’s Signature No. Paid by Check No. Cash Money Order Rent Receipt Date Received from The Sum of Dollars For the Period to For Rent at Received by Address Landlord’s Signature No. Paid by Check No. Cash Money Order Rent Receipt Date. In some cases, a rent receipt may be required for claiming tax deductions towards house rent allowance under the Income Tax Act, 1961. Further, the Indian Stamp Act, 1899 requires a receipt to be given on demand and also requires that a revenue stamp be affixed on receipts over an amount of Rs. 5000 (Rupees Five Thousand).

We have noted that most of the time employees provide incomplete rent receipts and multiple receipts which un-necessarily waste pages and time in record keeping.to overcome I have designed single page house rent receipt which covers everything in compliance with Income Tax.

Employer should circulate to their employees for proper record keeping.

From India, Mumbai

| Rent Receipt Format for full year.pdf (180.0 KB, 225 views) |

House Rent Receipt Format India Pdf Fillable

such formats may be useful for HR practice, but for legal compliance and disputes between the landlord and tenant, such rent bills will be void, under courta rent receipt is a commercial voucher for the bonafide existence of the tenant at the specified place and legal binding of the landlord to provide all amenities,

in normal practice just one or two rent receipts with similar statement is considered good, but from the view of TDS, the auditor will not consider it good if the amount exceed the 1 lacs slab per year, he will ask for all receipts and agreement copy also, without which the HRA would get clubbed to gross taxable amount

receipts may be in electronic form also but digitally signed by the landlord, as the payment is made monthly so receipt would be issued also monthly, not in a single sheet

If you are knowledgeable about any fact, resource or experience related to this topic - please add your views using the reply box below. For articles and copyrighted material please only cite the original source link. Each contribution will make this page a resource useful for everyone.

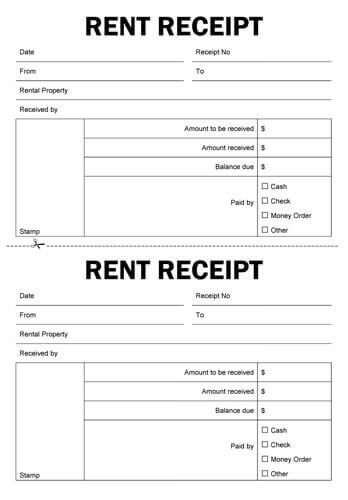

A Rent Receipt is a way to document rent payments that a Tenant makes to a Landlord. Rent Receipts give Tenants evidence that they have submitted payments to the Landlord as required. They also give Landlords a way to track incoming payments and monitor late payments or bounced cheques. For Tenants who pay their rent in cash, a rent receipt is often the only written proof they have to show that they paid rent at all. Often, both Landlords and Tenants choose to save copies of rent receipts for these reasons.

This Rent Receipt includes important information, including the amount of the rent payment, the date the payment was received, and the manner in which the payment was made (eg cash, cheque, electronic funds transfer etc). This Receipt also allows the Landlord to confirm whether the payment was a full or partial payment. If the Tenant made a partial rent payment, the Landlord can describe any late charges that the Tenant may then be required to pay in relation to any remaining payment which is overdue.

House Rent Receipt Format

How to use this document

Once the Rent Receipt has been filled out, the Landlord can send an original signed copy of the receipt to the Tenant and save a copy of the letter for their own records.

Applicable law

Leases may be subject to the rent control laws of individual states. However, these acts apply only to a tenancy of over 12 months. Further, the Transfer of Property Act, 1882 also contains provisions pertaining to lease of property. In some cases, a rent receipt may be required for claiming tax deductions towards house rent allowance under the Income Tax Act, 1961. Further, the Indian Stamp Act, 1899 requires a receipt to be given on demand and also requires that a revenue stamp be affixed on receipts over an amount of Rs. 5000 (Rupees Five Thousand).

How to modify the template

Indian House Rent Receipt Format Pdf Download

You fill out a form. The document is created before your eyes as you respond to the questions.

Download Rent Receipt Format

House Rent Slip Format India Pdf

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.